Installment Land Payment as a Scam in Real Estate

Introduction

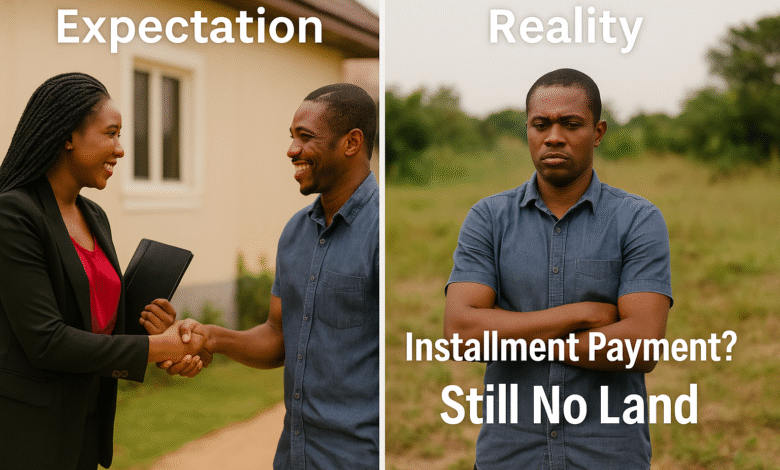

Installment land payment plans have become a popular sales tactic in Nigeria’s real estate space, and for good reason. They give everyday people a chance to invest in land without the pressure of paying millions upfront.

However, while the structure looks attractive on paper, it’s not always what it seems. Behind some of these “flexible payment” plans are hidden traps, delays, dishonesty, and in worst cases, outright scams.

Many innocent buyers have watched their dreams of land ownership slip away, not because they couldn’t pay, but because they trusted the wrong system.

Let’s break down how these installment traps work, and how to avoid becoming the next victim.

How Installment Land Payment Is Supposed to Work

In a genuine arrangement, you find a property listed for sale with a structured installment plan. The process usually goes like this:

- A price is quoted — say ₦2 million for a plot.

- Instead of paying everything at once, you agree to spread it across 6, 12, or 24 months.

- Some developers promise allocation after you’ve paid 50% or 70%.

- Others say you’ll get your plot at the end of the payment cycle.

This model is meant to help buyers ease into ownership. But many companies twist this structure to exploit the trust of unsuspecting customers.

Red Flags and Common Scam Tactics in Installment Land Payments

From experience, here are the common red flags to watch for, especially in Nigeria’s land market:

1. Midway Price Increases

Many companies start with a promo price just to get you in. But after 2 or 3 payments, they send an update: “Due to inflation, the cost of land has gone up.” You’re forced to pay more, even though you’ve signed up under a different agreement. This isn’t just unfair, it’s unethical.

2. No Allocation After Full Payment

Some buyers pay up to 100%, yet hear nothing about allocation. When they ask questions, they’re told to wait for the “next batch” or that allocation is “in progress.” In reality, the land might not even exist or the company has oversold the estate.

3. Your Land is ‘No Longer Available’

This one is common: after months of commitment, you’re suddenly informed that the exact land you paid for has either been sold or reassigned. You’re offered a smaller plot or one in a totally different location, far from what was promised.

4. No Legal Documentation

You’ve paid for months, but you’re still operating on verbal agreements, WhatsApp chats, and receipts. There’s no offer letter, no payment agreement, and no binding contract. That’s risky. If anything goes wrong, you have no paper trail to fight back with.

5. Excessive Penalties for Missed Payments

Legitimate developers give grace periods. But with shady firms, missing just one instalment can attract a ₦50,000 penalty — or worse, they cancel your plan and forfeit your previous payments. This kind of clause is often hidden or barely mentioned during sign-up.

6. Vague or Shifting Allocation Dates

If the company keeps avoiding the question of when you’ll get your plot be careful. Real estate companies with genuine land should give you a clear allocation schedule. If the answer keeps changing, that’s a sign something’s off.

How to Protect Yourself from Installment Land Payment Scams

Not all instalment plans are scams. Some reputable companies use them to help buyers enter the market. But you must be proactive:

- Always Request a Written Payment Agreement

Never rely on verbal promises. Therefore, ask for an offer letter and a signed contract detailing the land location, payment schedule, allocation date, and consequences of missed payments.

- Know the Allocation Timeline — and Get It in Writing

Ask: “At what point will I be allocated a plot?” If it’s after 50%, fine — but it must be clearly stated in the contract, with timelines.

- Insist on Site Inspection Early

Don’t wait until the end of your payment. Ask to visit the land upfront — and ideally again midway through the plan. If they keep giving excuses, that’s a red flag.

- Verify the Developer and the Land

First, search the company name on CAC, ask for the survey plan, layout, excision, or title documents. If they refuse to share or give excuses, walk away.

- Speak to a Property Lawyer

Before committing to any long-term instalment, have a lawyer review the terms. It might cost a bit upfront, but it’ll save you from a lifetime of regrets.

Conclusion

Installment land payments have helped many Nigerians start their journey to real estate wealth, but they’ve also ruined others.

The difference? Due diligence.

Before you sign any form or pay your first instalment, investigate, ask hard questions, and demand accountability. If the deal looks too good or too rushed, take a step back.

Remember: it’s better to miss a “promo” than to lose your entire savings.

If you’ve found this article helpful so far, you might also want to check out my book Land Ownership. I wrote it to help everyday buyers understand how land really works in Nigeria — the good, the risky, and the often overlooked. It goes deeper into some of the issues discussed here, especially around documentation, allocation, and long-term strategy.

Click here to get a copy.