Land Investment: Risks and Rewards Explained

Introduction

Investing in land has long been seen as a solid financial move, but like any investment, it comes with its own set of risks and rewards. Whether you’re a seasoned investor or someone looking to diversify your portfolio, understanding the intricacies of land investment is crucial. In this article, we’ll explore the various aspects of land investment, including its advantages, disadvantages, and how to navigate the potential risks.

What is Land Investment?

Land investment refers to the purchase of land with the expectation of earning a return on the investment, either through resale at a higher value or through development. Unlike other real estate investments, such as residential or commercial properties, land investments typically involve undeveloped plots without any immediate cash flow.

Why Consider Investing in Land?

The appeal of land investment lies in its potential for appreciation. Historically, land has appreciated in value over time, especially in areas experiencing growth or development. Additionally, land is a finite resource, there’s only so much of it available, making it a valuable and often secure investment.

Advantages of Land Investment

Potential for High Returns

One of the most compelling reasons to invest in land is the potential for significant returns. As areas develop, land values can increase substantially, offering investors the opportunity to sell at a much higher price than they initially paid.

Low Maintenance Costs

Unlike rental properties, land requires minimal maintenance. There are no buildings to upkeep, tenants to manage, or utilities to pay, making it a relatively hassle-free investment.

Flexibility in Use and Development

Land offers a level of flexibility that other types of real estate investments may not. Depending on zoning laws, you can develop the land, lease it, or simply hold onto it as a long-term investment.

Disadvantages of Land Investment

Liquidity Issues

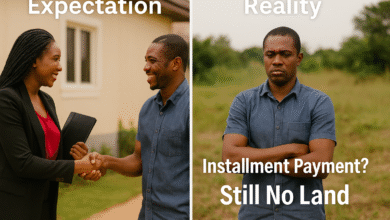

Land is not as liquid as stocks or bonds. Selling land can take time, especially if the market is slow or the land is located in a less desirable area. This means your money could be tied up for an extended period.

Long-Term Investment

Land investment is often a long-term commitment. It can take years for the land to appreciate significantly, and there are no guarantees that the value will increase as expected.

Market Volatility

The value of land can be influenced by various factors, including economic conditions, interest rates, and market demand. These factors can lead to volatility in land prices, which can impact your investment.

Evaluating the Risks of Land Investment

Investing in land carries various risks that must be carefully evaluated. These include:

Market Risks

Land prices can fluctuate based on economic conditions, interest rates, and market demand. Understanding these factors is crucial for making informed investment decisions.

Environmental and Regulatory Risks

Environmental regulations, zoning laws, and other legal considerations can impact the value and usability of land. It’s essential to conduct thorough due diligence before making a purchase.

Financial Risks

Investing in land requires capital, and there’s no guarantee of a return. Additionally, the cost of taxes, insurance, and potential legal fees should be factored into your investment decision.

How to Mitigate the Risks

To mitigate the risks associated with land investment, consider the following strategies:

Conducting Thorough Research

Before purchasing land, conduct thorough research on the location, zoning laws, environmental factors, and market conditions. This will help you make an informed decision.

Diversification of Investments

Diversifying your investment portfolio can help spread risk. Consider investing in different types of assets, including land, to reduce your exposure to any single market.

Legal and Financial Advice

Seeking advice from legal and financial professionals can help you navigate the complexities of land investment. They can provide insights into zoning laws, tax implications, and other important considerations.

Rewards of Land Investment

Despite the risks, land investment can offer significant rewards, including:

Appreciation Potential

Land has the potential to appreciate in value over time, especially in areas experiencing growth and development. This can result in substantial returns on your investment.

Generational Wealth

Land can be passed down through generations, providing long-term financial security for your family. It can serve as a valuable asset that appreciates over time.

Development Opportunities

Owning land provides opportunities for development, whether for residential, commercial, or agricultural purposes. This flexibility can lead to various revenue streams and increased value.

Conclusion

Land investment offers a unique opportunity to build wealth and secure your financial future. However, it’s essential to understand the risks involved and take steps to mitigate them. By conducting thorough research, seeking professional advice, and planning for the long term, you can make informed decisions and potentially reap the rewards of land investment.

Call To Action

Are you ready to secure your future with a smart land investment? Whether you’re looking for residential plots, commercial land, or farmland/agricultural property, we’ve got you covered! Visit our land listing website at reapse.co today to explore the diverse range of lands we have available for sale. Don’t miss out on these valuable opportunities.

Have questions or need expert advice? Contact us today for a FREE LAND CONSULTATION and let us help you make the best investment decision!

FAQs

1. What should I consider before investing in land?

Before investing in land, consider factors such as location, zoning laws, market conditions, and your financial goals. Conducting thorough research and seeking professional advice can help you make an informed decision.

2. How long should I hold onto land before selling?

The holding period for land investment varies depending on market conditions and your investment strategy. In general, land is a long-term investment, and you may need to hold onto it for several years to realize significant appreciation.

3. Can I get a loan to invest in land?

Yes, you can obtain a loan to invest in land, but the terms and availability may vary depending on the lender and the type of land. It’s essential to shop around and compare loan options before making a purchase.

4. What are the tax implications of land investment?

Land investment may have tax implications, including property taxes, capital gains tax, and potential deductions for expenses. Consulting with a tax professional can help you understand the specific tax considerations for your investment.

5. How do I find the right land for investment?

Finding the right land for investment involves researching the location, understanding zoning laws, evaluating market conditions, and considering your long-term goals. Working with a real estate agent or land broker can also help you identify suitable investment opportunities.

Stay tuned on our website to stay updated on real estate news, gain insights on real estate tips, and enjoy real estate stories where realtors share their experiences. You can also make money by sharing your own story. Don’t forget to drop your comments and join the conversation!